Introduction: In the dynamic world of investing, understanding the valuation of stocks is crucial for making informed decisions. When it comes to US ecology stocks, investors need to consider unique factors that affect their worth. This article delves into the key aspects of US ecology stock valuation, providing strategies and insights for investors looking to capitalize on this niche market.

Understanding US Ecology Stocks: US ecology stocks encompass companies that focus on environmental protection, renewable energy, and sustainable practices. These stocks are often seen as a way to invest in the future of the planet, as they contribute to reducing carbon emissions, preserving natural resources, and promoting a greener economy.

Key Factors in Valuing US Ecology Stocks

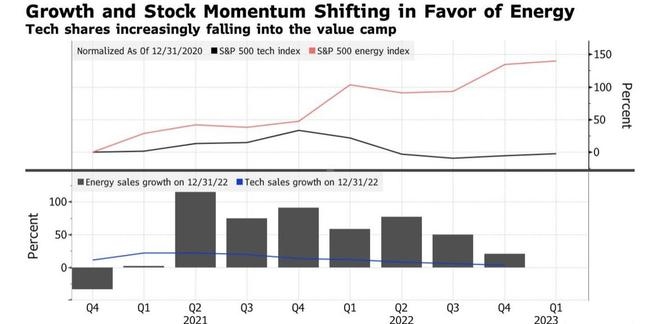

Economic Growth and Market Trends: Economic growth and market trends significantly impact the valuation of US ecology stocks. As the world moves towards sustainable practices, the demand for these stocks tends to rise. Investors should analyze market trends, such as the growing adoption of renewable energy sources, to assess the potential growth of ecology stocks.

Regulatory Environment: The regulatory environment plays a crucial role in the valuation of US ecology stocks. Favorable government policies, such as tax incentives and subsidies, can positively impact these stocks. Conversely, stringent regulations or lack of government support may hinder growth and negatively affect stock prices.

Financial Performance: Analyzing the financial performance of ecology stocks is essential for valuation. Key metrics to consider include revenue growth, profitability, and return on equity. A strong financial performance indicates a well-managed company with potential for future growth.

Technological Advancements: Technological advancements are a driving force behind the growth of US ecology stocks. Companies that invest in cutting-edge technology, such as renewable energy systems and sustainable materials, are likely to have a competitive edge and higher valuation.

Strategies for Valuing US Ecology Stocks

Discounted Cash Flow (DCF) Analysis:

Price-to-Earnings (P/E) Ratio: The P/E ratio compares a company's stock price to its earnings per share. A lower P/E ratio may indicate undervalued stocks, while a higher ratio may suggest overvaluation. Comparing the P/E ratio of US ecology stocks with industry averages can help investors identify potential investment opportunities.

Economic Moat: An economic moat refers to a company's competitive advantage that provides sustainable returns. When evaluating US ecology stocks, consider factors such as unique technology, strong customer relationships, and barriers to entry.

Case Study: Tesla, Inc. (TSLA) Tesla, Inc. is a prime example of a successful US ecology stock. By focusing on electric vehicles and renewable energy solutions, Tesla has become a leader in the industry. Its stock valuation has been influenced by several factors, including:

Conclusion: Valuing US ecology stocks requires a thorough understanding of economic trends, regulatory environments, and financial performance. By employing various valuation methods and analyzing key factors, investors can make informed decisions and capitalize on this niche market. Remember to stay informed about market trends and keep an eye on technological advancements to identify potential investment opportunities in the US ecology sector.

nasdaq composite